How you can get a Private Property in Singapore before 35 years old.

Buying property in Singapore is a national obsession.

Buying private property in Singapore is a Singaporean Dream.

Buying private property in Singapore before age 35 is almost like an IMPOSSIBLE FEAT.

Why is that so?

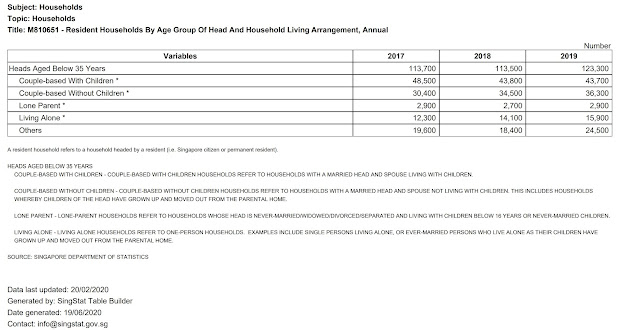

Based on Singstat, the number of Singapore residents from 2017 to 2019 aged below 35 are as shown:

In 2019, we have 293,000 residents aged below 35 among 4 million residents. That's about 7% of our population.

As the SingStats doesn't specify number of residents owning Private Property under aged 35, we can infer from their data that about 123,000 households own property under age 35 and we can assume Lone Parents, Living Alone and Others as more likely to be owning Private Property.

As HDB ownership for couples are nearly 90%, we can estimate 10% of the 80,000 households to be living in Private Property.

We can estimate about 50,000 households under aged 35 owns Private Property.

So out of 1,372,000 households as of 2019, 50,000 households under aged 35 owns a private property. That is about 3.6% of the resident population.

In order to achieve the impossible feat to afford a private property, these are the 3 methods to help me get a private property before age 35.

1. Set a Goal

Let's be honest. You really need a lot of cash to buy a property in Singapore. This is the reality. Any advertisement telling you can own multiple properties with minimal cash is not true. It is possible to do that but that requires many people to pool their cash into a registered company to purchase properties. This means CASH is required to pay properties.

If you want to buy a private property at a purchase price of SGD 1 million, you would have to cater about 10% for cash upfront for:

a) Option Fee 1%

b) Exercise Fee 4%

That's your 5% cash upfront. There's also other fees such as:

c) Stamp Duty Fees at about 3% approximate

d) Legal Fee approximate SGD 3,000

e) Bank Loan Stamp Duty SGD 500

f) CPF Admin Fee SGD 430

That's about 8% of the Purchase Price. If you have Additional Stamp Duty Fees depending on your situation, you will need more cash.

However, 10% will be a general guideline of how much cash upfront you will require.

So now you know you will need SGD 100,000 in cash. That is your Goal Setting.

You may also have to consider some cash for renovation and furniture. A general guide of SGD 50,000 is pretty decent. There will be a write-up on what I did for renovation.

2. Breakdown Plan

How do you plan to accumulate SGD 100,000?

Let's assume you are currently 30 years old. That will mean you need to save SGD 20,000 each year which translate to SGD1700 per month. That's saving SGD 55 per day.

It's that simple. You can adjust your savings according to your timeframe.

This is where your discipline on expenditure control comes in handy.

Again, the earlier you plan the easier it is to save. It is difficult to give any advice in this area, that will require a detail explanation or breakdown on your personal finance. Drop your comments to see what I can share. I'm not a financial advisor, just a regular guy with a plan.

3. Understand Current Market Conditions

With your cold hard cash lock up in your war chest, you are ready to shop.

Shopping for a property is an emotional process. You need hard facts and data to anchor yourself. Everyone will give you an opinion on what to do and not to do. Especially so when your parents give advice. Friends you long forgotten pop up to give advice too!

How ever well meaning they would like to be, it is ultimately your decision and you need to have data and facts to anchor your decision making process or it will be extremely difficult to buy a property.

a) The Stock Market predicts the Property Market.

One of the most important leading indicators on the Singapore current property market is the STI Index. It literally predicts how the Property market will react.

Above I transpose the STI Index with data from URA PPI.

June 2007 STI index is showing a downward trend and almost a year later the PPI peak and starts to drop.

You can also see STI starts to pick up in March 2009 and in 3 months there is noticeable pick up in PPI.

As most analyst knows, the recession cycle comes every 10 years or thereabouts.

We should expect one in 2018 but it didn't happen exactly. The Property market wasn't faring well during 2017 until there was a slight pick up in 2018.

As you can see STI has a slight upward tick towards end of 2016. The Property market experience positive vibes towards end of 2017 due to the en-block sales happening through Singapore.

You can see 2018 seems to be a positive year for the property market.

From 2013 to 2017 saw the PPI experience a downward trend due to the government intervention on ABSD rules. In a way it seems that the drop was gradual and the government manage to cushion the fall very well.

I bought the property when the market was not feeling positive when the URA PPI was at 154.9. Today the index is pushing 180. That's about 5% year on year increase. You can say that I bought it at the low period. But I was unsure in 2017. I do know that the news were not optimistic on the market outlook.

b) Profits are locked in when you BUY not when you SELL

Just like when you invest in stocks, you have to under the concept that profit is locked in at the point of purchase.

In any case, buying property in Singapore in the long run is profitable. The only question is your expectation.

In my case, as long as the property value is increasing more than inflation rate, that is a good investment. My expectations are pretty low compared to expert property investors.

I keep to 5% year on year as a reference basis. Anything more than 5% is considered very good.

c) Buy within your means

This is important if you don't want to wake up in the middle of the night thinking if you can afford the bank loan repayment.

There are 3 things that you must know when you are buying property:

1) AIP letter

Before you look for a property, it is important to check with banks what amount you can borrow based on your salary. Ask for the Approval-in-Principle Letter that will estimate your loan amount.

With the AIP letter, agents and sellers will know you are a serious buyer and not just asking to view the house for fun. A point to note is that AIP letters expires in 1 to 3 months depending on the bank.

The AIP letter will indicate what will the range of property that you can afford.

2) Loan repayments

When you know how much you can borrow, you can estimate your range to offer.

To make sure that the monthly repayments do not affect my monthly expenses, I calculated to maximise the CPF OA.

Considering that I am working now and contributing to the CPF OA, the bank loan repayments will deduct from my CPF OA each month. For example, if the bank loan is $2000 per month and my monthly contribution to the CPF OA is $1100 every month, it would deduct $900 from my CPF OA original amount.

This would take 5 to 7 years before my CPF OA reaches the minimum amount it can be.

If I am no longer working, the bank loan repayments would continue to deduct for about 3 years.

So it is important to manage the loan repayments and I prefer to max out the CPF OA as much as possible.

I know that I have 3 years buffer to pay my bank loans if I am out of a job.

3) Renovation Costs

After getting the property, the next big ticket item is definitely spending on the furniture and renovation. It is alot of cash to spend. It can spiral out of control if it is not managed properly.

It is important to fix a budget and stick to it. Renovation costs can throw you a sucker punch when you least expect it.

For example, I wanted to have a tiled concrete bath tub in my bathroom but that was scrapped when the contractor quoted a price way out of my budget.

You would also have to consider the cost of maintenance when you renovate a place. There are plenty of examples to show on my next writeup.

Summary

There you have it! The 3 methods I observe to get a private property before age 35.

Fun fact: I bought it at age 33. It should be 32 but I signed it a few days after my birthday.

~tschuss!

Comments

Post a Comment